michigan.gov property tax estimator

In 2012 Michigans statewide flat tax rate fell from 435 to 425 although the city. The Revenue Act includes provisions for charging penalty and interest if a taxpayer fails to pay a tax within the time specified.

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Interest is calculated by multiplying the unpaid tax.

. Michigan is ranked number eighteen out of the fifty. Homestead Property Tax Credit. Business Tax Forms Instructions.

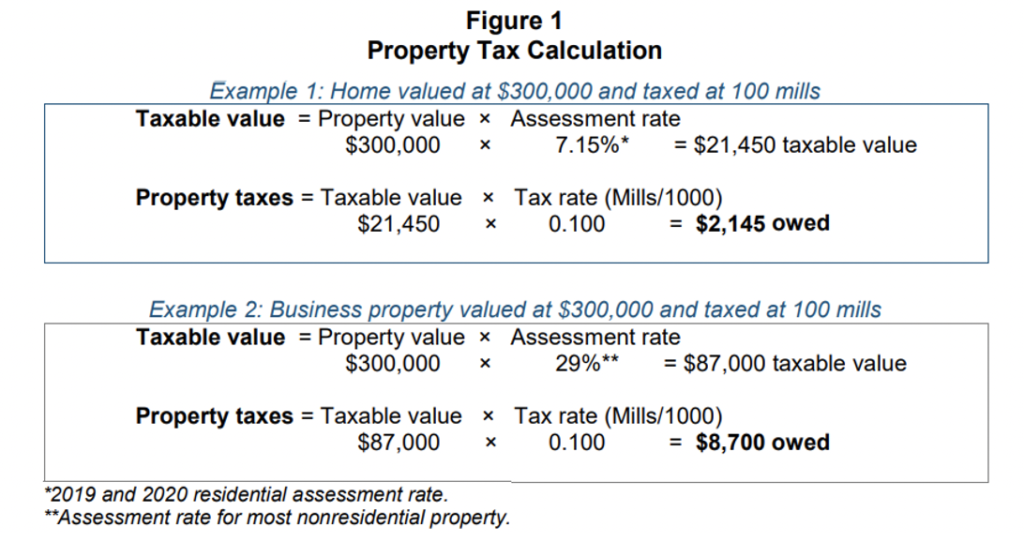

Counties in Michigan collect an average of 162 of a propertys assesed fair. The Great Lakes State has made a number of changes to its tax code in recent years. Use this estimator tool to determine your summer winter and yearly tax rates.

Office of Inspector General. This system contains US. Tax Estimator Tax Estimator You can now calculate an estimate of your property taxes using the current tax rates.

You can now access estimates on property taxes by local unit and school district using 2021 millage rates. By accessing and using this computer system you are consenting to system monitoring for law enforcement and other. The median property tax in Michigan is 214500 per year for a home worth the median value.

Office of the Auditor General. Use this estimator tool to determine your summer winter and yearly tax rates and amounts. The Essential Services Assessment ESA is a state specific tax on eligible personal property owned by leased to or in the possession of an eligible claimant.

This link will provide. Departmental Authors Employee Email. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax.

Worksheets 4 Recipients of FIPMDHHS 5 Renters Age 65 Estimator. Simply enter the SEV for future. Property Tax Estimator Property Tax Estimator You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

State of michigan property tax estimator. Simply enter the SEV for future owners or the Taxable Value. Worksheet 2 Tier 3 Michigan Standard Deduction Estimator.

Michigan property transfer tax estimator. Acme township 2013 millage rate. Michigans Wayne County which contains the city of Detroit has not only the highest property tax rates in the state but also some of the highest taxes of any county in the US.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Enter the Taxable Value of your property and select the school district from. 41010 - Grand Rapids 41020 - Godwin 41050 - Caledonia 41110 - Forest Hills.

2 days agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. Follow this link for information regarding the collection of. Property Tax Estimator Property Tax Estimator You can now access estimates on property taxes by local unit and school district using 2021 millage rates.

Application for State Real Estate Transfer Tax SRETT Refund. Simply enter the SEV for future.

Michigan Property Taxes Estimator Jeremy Drobeck Amerifirst Home Mortgage

Compare 2021 Millage Rates In Michigan Plus Fast Facts On Property Tax Trends Mlive Com

Michigan Department Of Treasury Taxes

How Mi Property Taxes Are Calculated And Why Your Bills Are Rising

Where S My Refund Michigan H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation

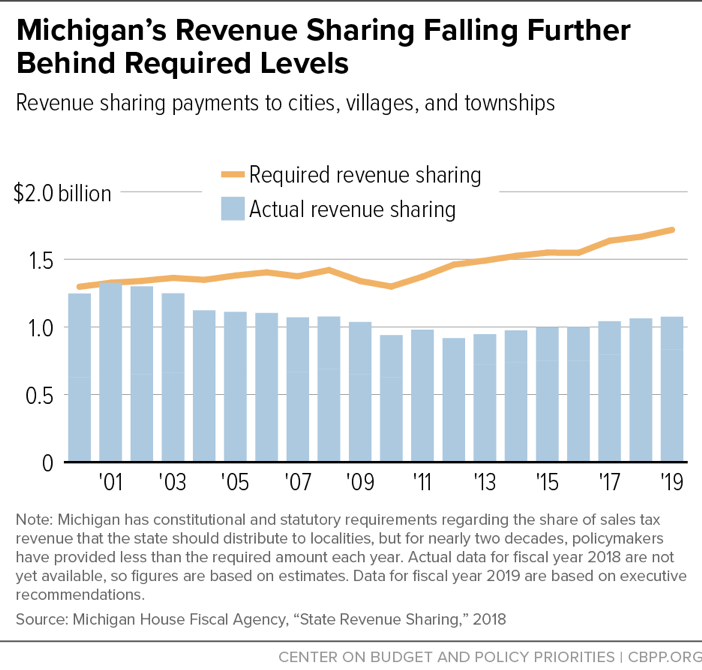

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Township Tax Shelters Georgetown Public Policy Review

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Homeowners Property Exemption Hope City Of Detroit

Where Are Property Tax Rates Highest And Lowest In Michigan Mlive Com

Michigan Property Taxes Estimator Jeremy Drobeck Amerifirst Home Mortgage

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute