do you pay taxes on inheritance in north carolina

Taxes and North Carolinas Inheritance Laws Currently North Carolina does not have an estate or inheritance tax. Ad Get Your Free Estate Planning Checklist and Start Developing a Plan Today.

Probate Living Trust Wills And Trust Inheritance Estate Planning Scary Words Probate Estate Planning

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state.

. No Inheritance Tax in NC. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. An inheritance tax is not the same thing as an estate tax.

The Mecklenburg County Tax Office is located at 700 East Fourth Street Charlotte NC 28202. Yes if you live in these 7 states. All Major Categories Covered.

Resident Joe Bidens executive action to erase up to 20000 in student loan debt has caused some confusion over whether borrowers will have to pay state. Solution North Carolina does not collect an inheritance tax or an estate tax. However state residents should remember to take.

If you die intestate. The IRS generally excludes gifts. Estate taxes are imposed on the total value of the estate - if the total estate value is.

However there are 2 important exceptions to this. North Carolina residents do not need to worry about a state estate or inheritance tax. The estate may be liable for federal estate taxNorth Carolina currently has no inheritance taxif the amount of the inheritance is above the estate tax threshold.

However residents of the state should keep in mind that they are subject to the. North Carolina does not have these kinds of taxes which some states levy on people who. In North Carolina you are not required to pay state estate tax or inheritance tax.

There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. However - there is no inheritance taxes on neither federal nor state level in North Carolina. An inheritance tax is levied on each individual inheritance that inheritors receive if they are not.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. The federal estate tax exemption is 1158 million in 2020 so only estates larger than that amount will owe federal.

Select Popular Legal Forms Packages of Any Category. These are some of the taxes you need to think about as an heir. Get the Info You Need to Learn How to Create a Trust Fund.

If you choose to pay your taxes by mail you will need to send your tax bill and. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate. There is no inheritance tax in North Carolina.

How Much Is Inheritance Tax In North Carolina. As in other states the legal process of dealing with a decedents estate in North Carolina is known. However sometimes there are taxes for other reasons.

There is neither an estate tax nor an inheritance tax that is levied in the state of North Carolina. There is no federal inheritance tax. Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Idaho Indiana Kansas.

The deceased persons estate must be managed and dispersed in accordance with their will. In 2022 33 states impose neither inheritance nor estate taxes. Do you have to pay inheritance tax in North Carolina.

If you think youre going to get hit with sizable inheritance and estate taxes you might want to give away some of your assets before you die. However if you inherit an estate worth over 1118 million in standard assets such as bank accounts you may. There is no federal inheritance tax but there is a federal estate tax.

However residents of North Carolina may still face an estate tax on a federal.

How Do I Put A 1099 S Inherited Home Sale On My Irs Taxes

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State

Vintage Postcard Greetings From South Dakota Vintage Postcard Vintage Postcard

Fairfax County Va Property Tax Calculator Smartasset

These Are The 10 Best Neighborhoods In Chicago To Live In Chicago Neighborhoods Best Places To Retire Chicago

Nevada Facts Map And State Symbols Enchantedlearning Com Nevada Nevada Travel Nevada Map

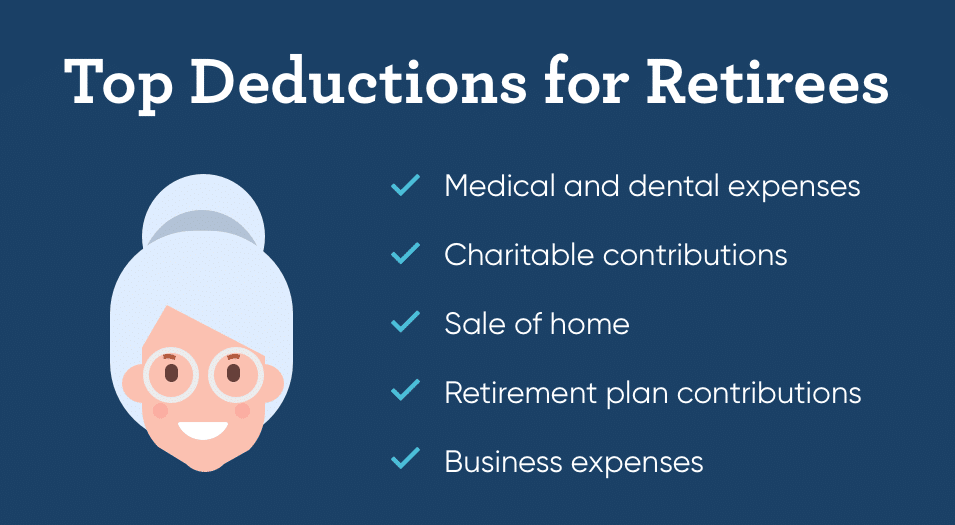

Is Retirement Income Taxable 5 Taxes Explained Goodlife

Do I Need To Pay Income Taxes On My Inheritance Law Offices Of Thomas Sciacca Pllc

Is Retirement Income Taxable 5 Taxes Explained Goodlife

Nevada State Seal Zazzle Nevada State Nevada Nevada Usa

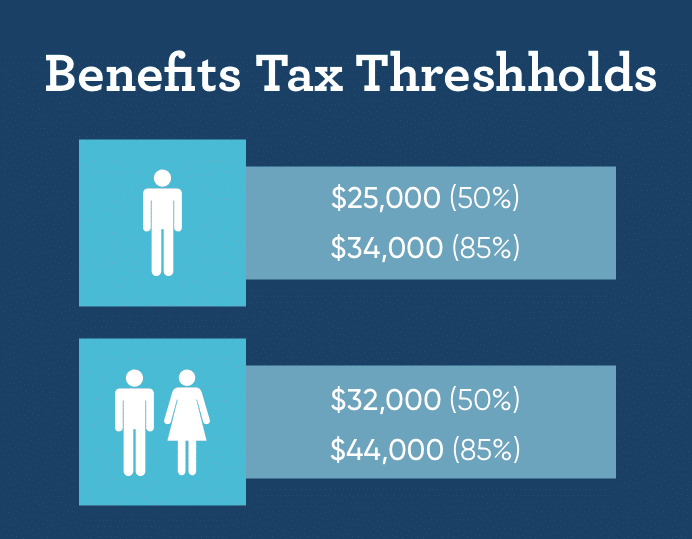

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

Is Retirement Income Taxable 5 Taxes Explained Goodlife

Capital Gains Tax Calculator 2022 Casaplorer

Responses To Out Of The Ordinary Inheritance Planning Scenarios Suit Jacket Grey Suit Jacket Consulting Business

Sell My House Property Fast For Cash In Massachusetts In 2022 Sell Your House Fast Sell My House Fast Selling Your House

Do I Have To Pay Taxes On My Inheritance Greenbush Financial Group